Los Azules Feasibility Study Confirms Economically Robust Copper Project With Leading ESG Performance

TORONTO, Oct. 07, 2025 (GLOBE NEWSWIRE) -- McEwen Copper Inc., 46.4% owned by McEwen Inc. (NYSE, TSX: MUX) is pleased to announce positive results from the independent Feasibility Study (FS) for its 100%-owned Los Azules copper project in San Juan, Argentina.

The FS confirms Los Azules as a long-life, low-cost producer of high-purity copper cathodes with strong economic returns and sustainability. The project design advances Los Azules toward construction readiness within a framework that reduces its environmental footprint. Project risk has been further reduced through a strategic collaboration agreement with IFC to potentially lead debt financing and additional funding proposals for infrastructure and construction.

With these results, Los Azules is positioned to become a supplier of responsibly produced copper, critical to the global energy transition towards a low-carbon sustainable future.

“The Los Azules Feasibility Study is more than a technical milestone - it’s a blueprint for the future of copper mining. We have delivered a plan for a long-life asset that will play a role in the world’s clean-energy transition. Copper is the foundation of electrification and the modern world, and Los Azules is ready to contribute to that global supply chain - responsibly, efficiently, and profitably,” said Rob McEwen, Chairman and Chief Owner of McEwen Inc.

“With this Feasibility Study, our team has transformed the geological potential of Los Azules into a clear, actionable development plan. This work gives us confidence in the project’s design, costs, and schedule, providing the foundation for the next stage of growth.

“Having significant experience with large-scale construction and mining operations in Argentina, I am confident that we have the right plan, the right team, and the right partnerships to develop Los Azules. Together with our local communities and government partners, we aim to create Argentina’s first regenerative copper mine - a model for responsible and innovative mining,” said Michael Meding, Vice President of McEwen Copper and General Manager of Los Azules.

This press release starts with the FS Highlights below, followed by Footnotes, a Glossary of Terms, Units and Abbreviations and continues with a detailed account of the study in a Technical Appendix.

FS Highlights

Simple Takeaways

-

Economics After-tax(1):

NPV(8%) $2.9B

IRR 19.8%

Payback Period 3.9 yrs

Initial Capital $3.17B

-

Copper Cathode Production(2):

Average Years 1–5 204,800 tonnes per year (451M lbs/yr)

Life of Mine 21 years

Average Production 148,200 t/yr (327M lbs/yr)

-

Costs:

C1 cash cost $1.71/lb

AISC $2.11/lb

-

Scale – Reserves and Resources(3):

Mineral Reserves

- Proven & Probable 10.2B lbs Cu (1.02 B tonnes at 0.45% Cu)

Mineral Resources (exclusive of Reserves)

- Measured & Indicated 5.4B lbs Cu (0.97 B tonnes at 0.26% Cu)

- Inferred 20.0B lbs Cu (4.24 B tonnes at 0.21% Cu)

-

Capital Intensity Using:

LOM Capital &

Production $1,600/t Cu

Initial Capital &

Avg. Annual Production $20,200/t Cu per yr

Designed for Low Impact

- Leach + SX/EW process produces 99.99% copper cathodes (LME Grade A) on site (no smelter required).

-

Project design provides:

- 72% lower mine-to-metal carbon intensity than industry average for mine-to-metal

- 100% renewable power(4) (wind, hydro, solar)

- 74% less water use than conventional milling

- No tailings dam

- Carbon-neutral (Scopes 1 & 2) goal by 2038.

De-risked Regulatory Status

- Environmental Impact Statement EIA (Environmental Permit) for construction and operation was approved by the San Juan Provincial Government's Ministry of Mines in December, 2024.

- Accepted into Argentina’s Large Investment Incentive Regime (RIGI) in September, 2025, providing tax, foreign exchange and customs stability for 30 years, legal certainty, foreign exchange regulations allowing to leave export proceeds abroad in increasing steps that will reach 100% by the time the project starts exports and access to international arbitration in case of disputes.

Ownership & Partners

-

Ownership: McEwen Inc. 46.4%, Stellantis 18.3%, Nuton (Rio Tinto) 17.2%,

Rob McEwen 12.7%, Victor Smorgon Grp 3%, Others 2.4%. - Preliminary finance proposals from Tier-1 OEMs (Komatsu, Sandvik & others), YPF Luz, European ECAs, and a collaboration agreement with IFC(5) to align with IFC’s ESG standards and for potential financing. Indicative proposals could support $1.1B+(6) in equipment and infrastructure financing.

Future Growth Opportunities Beyond the FS

- Nuton® leaching technology (Rio Tinto venture) could allow processing of primary ores with the existing infrastructure (indicative recoveries >76%), or a Conventional Concentrator could also provide higher copper recoveries, plus recover gold and silver as well. Either process could extend mine life by 30+ years by economically treating primary sulfides. Neither of these opportunities are included in the FS base case.

- Exploration has shown that there are four porphyry targets near the Los Azules deposit that could provide further extension to the mine life. Exploration of the newly identified targets will start in Q4 2025. High-priority targets near Los Azules include Tango, Porfido Norte, Franca, and Mercedes.

Timeline & Next Steps

- FS NI 43-101 Technical Report to be filed: within 45 days(7).

- Water concession: application under review.

- Construction target: 2026 → SX/EW startup: 2029 → First copper: 2030.

Footnotes to Highlights

(1) NI 43-101 feasibility study using a copper price of $4.35/lb or $9,592/ tonne for cash flow modeling.

(2) Average copper recovery is 70.8% over the life of mine.

(3) For additional details on the calculation of Mineral Resources and Mineral Reserves see Section 3 of the Technical Appendix, Mineral Resource & Reserve Estimates.

(4) Power supply 100% renewable, with 48% lower electricity demand than a conventional concentrator.

(5) Collaboration agreement signed with IFC to align with IFC’s ESG standards for potential future financing, an important milestone in McEwen Copper’s broader financing strategy.

(6) Preliminary financing proposals from Tier-1 OEMs, YPF Luz, and European ECAs could provide $1.1B+ in equipment and infrastructure support.

(7) The FS NI 43-101 Technical Report will be filed within 45 days on SEDAR and McEwen Inc.’s website at https://www.mcewenmining.com/investor-relations/reports-and-filings.

ABOUT MCEWEN INC.

McEwen Inc. shares trade on both the NYSE and TSX under the ticker MUX.

It provides shareholders with exposure to a growing base of gold and silver production in addition to a very large copper development project, all in the Americas. The gold and silver mines are in prolific mineral-rich regions of the world, the Cortez Trend in Nevada, USA, the Timmins district of Ontario, Canada and the Deseado Massif in Santa Cruz province, Argentina. McEwen Inc. is considering reactivating a gold and silver mine in Mexico.

It has a 46.4% interest in the large, long-life, advanced-stage Los Azules copper development project in San Juan province, Argentina – a region that hosts some of the country’s largest copper deposits. The Los Azules copper project is designed to be one of the world’s first regenerative copper mines and carbon neutral by 2038.

Rob McEwen, Chairman and Chief Owner, has a personal cost basis for his investment in the companies of over $200 million and takes a salary of $1 per year, aligning his interests closely with shareholders. He is a recipient of the Order of Canada, a member of the Canadian Mining Hall of Fame and a winner of the Ernest & Young Entrepreneur of the Year (Energy) award. His objective is to build MUX’s profitability, share value and eventually implement a dividend policy, as he did while building Goldcorp Inc.

ABOUT MCEWEN COPPER

McEwen Copper Inc. is a Canadian-based private company with a 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek copper/gold project in Nevada, USA.

Based on S&P Global data for 2024, Los Azules projected annual production would rank it as the 26th worldwide, once in production, placing it in the top 6% of all 423 copper producers. The project also ranks 10th globally in terms of total Mineral Resources among all undeveloped copper porphyry deposits (company disclosure).

Los Azules is being designed to provide a model to the industry for a more sustainable, low-carbon future and to help improve public perception of mining by fundamentally differing from conventional copper mines –substantially reducing water consumption and carbon emissions and operating on 100% renewable electricity once in production.

Glossary of Terms, Units and Abbreviations

AISC - All-In Sustaining Cost (C1 + sustaining capital + royalties + taxes)

Approx. - Approximately

B - billion

Blb - billion pounds

Copper cathode - High-purity (typically 99.99%) of refined copper sheets (LME Grade A) produced through an electrolytic refining process. This finished product serves as a primary raw material for high-quality copper products, such as wires, tubes, and various alloys.

CO₂-e/t Cu - Kilograms of CO₂ equivalent per tonne of copper

Cu - copper

C1 Costs - Direct cash costs of production

EIA - Environmental Impact Assessment

FS – Feasibility Study

GHG Emissions - Greenhouse gas emissions (CO₂-equivalent)

Heap Leach - Process of extracting metals by percolating acid through ore piles

Hypogene or Primary - Refers to mineralization formed by ascending hydrothermal fluids deep below the surface, usually at high temperature and pressure

IFC - International Finance Corporation

IRR (Internal Rate of Return) - Rate at which NPV = 0

ktpa - 1,000 tonnes per annum

km - kilometer

lb - pound (0.4536 kg)

leach project - project using heap leach process

LOI - Letter of Intent

LOM - Life of Mine

L/s - 1 liter per second

m - meter

M - million

MW – megawatt (1,000,000 watts)

Mlb - million pounds

NPV (Net Present Value) - Present value of future cash flows discounted at 8%

NSR – (Net Smelter Return) - a royalty based on a percentage of metal produced based on the metal sale proceeds less the cost of refining at an off-site refinery (Metal Price × Payable Metal Content) − (Treatment Charges + Refining Charges + Penalties + Transport/ Insurance/ Marketing Costs)

NTP – Notice to Proceed

Nuton® - Rio Tinto’s proprietary Nuton technology

OEM - Original Equipment Manufacturer

oz - troy ounce (31.1 grams)

Primary or Hypogene – Refers to the original ore minerals formed during the initial geological processes (e.g., magmatic or hydrothermal activity). Primary mineralization is typically found at depth and is unaltered by surface weathering.

RIGI - Argentina’s Large Investment Incentive Regime

SX/EW - Solvent Extraction / Electrowinning

Secondary - Refers to ore minerals or enrichment formed after the primary (hypogene) stage, usually by supergene processes (weathering, oxidation, and downward percolation of fluids near the surface).

Soluble Copper (CuSOL) – the amount of copper assayed using sequential methodology that includes acid soluble and cyanide soluble assayed components. Acid soluble copper generally represents readily acid dissolvable oxide, carbonate and similar copper minerals. Cyanide soluble copper generally represents secondary copper minerals that are readily leached with commercial bioleach technology (chalcocite, digenite, covellite)

Supergene - Secondary ore minerals formed near the Earth’s surface through weathering, oxidation, and groundwater movement. Metals are leached from upper zones and reprecipitated at depth, often creating an enriched zone of higher-grade mineralization.

Total Copper (CuT) – the amount of copper contained in all mineral forms in the deposit by conventional assaying methodology. Total copper includes the soluble copper component.

t - tonne (1,000 kg)

yr - year

Technical Appendix

The information in this appendix is provided for technical readers and analysts.

1. Project Overview

Property Description

Exploration Targets

A Sustainable Approach

2. Copper Price Assumption

3. Mineral Resource & Reserve Estimates

Updated Mineral Resource Estimate

Maiden Proven and Probable Mineral Reserve Estimate

4. Metallurgy & Recovery

5. Economic Analysis

Economic Metrics

Sensitivity Analysis

6. Capital & Operating Costs

Capital Costs Estimates

YPF Funding Power Supply

Operating Costs Estimates

7. ESG & Sustainability

8. Permitting & Regulatory Status

9. Development Timeline

10. Nuton® Opportunity

11. Strategic Partnerships

12. Study Contributors and Qualified Persons

13. End Notes

1. Project Overview

Property Description

Located in Calingasta District, San Juan Province, Argentina, on the border with Chile. The Los Azules copper project is a classic Andean-style porphyry copper deposit. The large hydrothermal alteration system spans at least 5 kilometers (km) by 4 km, elongated along a north-northwest major structural corridor. The Los Azules deposit area itself is approximately 4 km long by 2.2 km wide and lies within the alteration zone.

The limits of the Los Azules mineralization along strike to the North and at depth have not yet been defined. Near-mine primary or hypogene copper mineralization extends to at least 1,000 m below the surface. Near surface, leached primary sulfides (mainly pyrite and chalcopyrite) were redeposited below the water table in a sub-horizontal zone of supergene enrichment as secondary chalcocite and covellite. Hypogene bornite appears at deeper levels together with chalcopyrite. Gold, silver, and molybdenum are present in small amounts, however copper is the economic driver at Los Azules.

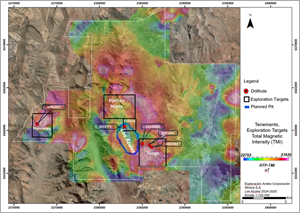

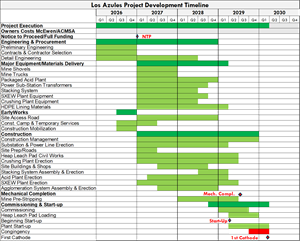

Exploration Targets

Porphyry exploration targets near to Los Azules include Tango, Porfido Norte, Franca, and Mercedes. They are a priority for next season’s exploration (see Figure 1). These targets offer the potential to enlarge the size of resources and extend the life-of-mine beyond that presented in this study.

The Franca target, with high-grade intercepts, shows the potential to extend the Los Azules resource to the northeast. The Mercedes target west of Los Azules has hydrothermal alteration and similar surface geology to Los Azules and has the indication to be another hidden porphyry, like Los Azules. Porfido Norte is a target that is located along the main Los Azules structural corridor with indications of a suitable intrusive suite of rocks with hydrothermal alteration. Finally, the Tango target will be mapped in detail to better understand the potential drill targets.

Figure 1: Los Azules deposit (outlined in blue), and exploration targets Mercedes, Porfido Norte, Franca and Tango (black squares). Satellite image with Total Magnetic Intensity map.

Heap Leach SX/EW — The Preferred Path Forward

The FS is based on a heap leach process using solvent extraction-electrowinning (SX/EW) to produce 99.99% copper cathodes (LME Grade A equivalent) for sale in Argentina or international markets. There are three principal reasons why the implementation strategy remains a leach project, as in the 2023 PEA(11):

- Environmental Footprint: Process water consumption is 74% lower than a milling operation (158 L/s LOM average vs. 600 L/s). Net electricity demand is 48% lower than a concentrator (119 MW vs. 230 MW). GHG emissions are 72% lower than the average mining operation (1,082 vs. 3,930 kg CO2-e/t Cu for Mine-to-Metal(12), with a roadmap to achieve further reductions through new technologies, with the ultimate goal of reaching net-zero carbon by 2038 with some offsets. Los Azules copper cathodes will thus be attractive to end-users seeking to measurably reduce their upstream environmental impacts.

- Reduced Permitting Risk: With the approval of our Environmental Impact Assessment on December 3, 2024, and the approval of our application for the Large Investment Incentive Regime (RIGI) on September 26, 2025, and the expected approval of our Water Concession permit for operations, Los Azules is well positioned to begin construction. The project uses heap leach technology that is well accepted in the San Juan Province today. It also eliminates tailings and tailings dams, conserves scarce water resources, and reduces the overall complexity of the mine, optimizing the permitting process.

- Producing Cathodes: The leach process will produce LME Grade A copper cathodes, which can be used directly in the fabrication of copper products, both within Argentina and internationally. The production of copper cathodes eliminates reliance on third party foreign smelters for the processing of concentrates into refined copper products. It also eliminates significant GHG emissions associated with transportation, and pollution associated with smelting. Counterparty and pricing risks are also reduced.

A Sustainable Approach

The FS marks another significant step toward our goal of reducing our environmental footprint. Greater environmental and social stewardship sets our project apart from other potential mine developments, which appropriately justifies certain economic trade-offs. Trade-offs to achieve the environmental benefits of heap leaching are lower overall copper recovery, slightly higher unit costs, and less immediate cashflow due to extended leach cycles. Nevertheless, the leach project remains economically attractive. Furthermore, McEwen Copper believes that some of these drawbacks can be mitigated by implementing developing technologies such as the Nuton® Technology, discussed below. Additionally, trolley-assist haulage, conveyor waste haulage, and In-Pit Crush and Convey (IPCC) will be further evaluated during the detailed engineering stage to continue to reduce the mine’s carbon footprint. Additionally overall CAPEX is lower than comparable concentrators.

The team has also worked safely with 1,848,632 man-hours worked since our last Lost Time Incident and since January of 2022 we have worked a total of 2,367,891 man-hours to achieve this study result.

We developed regenerative guiding principles to frame our approach to sustainable innovation and set high-reaching goals addressing all facets of the mining and processing options considered for Los Azules. The project development seeks to significantly reduce the environmental footprint of mining operations and their associated GHG emissions by integrating the latest renewable and environmentally responsible technologies and processes. The project has letters of intent (LOIs) to obtain 100% of its energy from renewable sources (wind, hydro, and solar), primarily from YPF Luz, using a combination of off-site and onsite installations. The project is also seeking to have long-term net positive impacts on the greater Andean ecosystem, local flora and fauna, the lives of miners, and citizens of nearby communities, while contributing positively to the local and national economy of Argentina. Refer to the full FS NI 43-101 Technical Report for more information about our regenerative approach.

2. Copper Price Assumptions

The copper price used for mineral reserves in the FS was $4.25 per pound and $4.80 per pound for mineral resources, in line with analysts’ consensus projections for long-term copper prices that range between $3.55 and $5.00 per pound, with a median price of $4.25 per pound. The mineral resource price was set at 113% of the mineral reserve price.

Economics in the cashflow model were analyzed at $4.35 per pound copper. This reflects analysts’ consensus at the time of publication of the feasibility study.

3. Mineral Resource & Reserve Estimates

The FS includes an updated independent Mineral Resource and a maiden Mineral Reserve estimate, which contains a Mineral Resource of 5.4 B lbs Cu Measured and Indicated (965.5 million tonnes at grade 0.255% Cu) and 20.0 B lbs Cu Inferred (4,239.3 million tonnes at grade 0.214% Cu) (exclusive of Reserves), and a maiden Mineral Reserve of 10.2 B lbs Cu Proven and Probable (1,023.1 million tonnes at grade 0.453% Cu).

This study provides an update on the work done for the 2023 Los Azules PEA. Drilling more than 120,000 meters with more than 2.3 M man-hours worked in the last three seasons has upgraded the resource categories to allow us to present a Mineral Reserve in the FS similar to the 1.182 B tonnes of mineable Mineral Resources containing 10.9 B lbs Cu in the 2023 PEA. This achievement included a campaign during the 2023/2024 season with 70,000 meters drilled and up to 23 rigs operating simultaneously at site.

This program was executed in collaboration with seven drilling contractors, including two local ventures that were operating LF160 Boart Longyear rigs owned by McEwen Copper. During this period, the company also acquired the largest fleet of LF160s in South America and assembled a highly trained team to support the ambitious drilling program.

Maiden Proven and Probable Mineral Reserve Estimate

The Los Azules project is to be developed as a large-scale open pit mining operation. 1.02 billion tonnes of ore will be mined at average diluted head grades of 0.45% Cu and a strip ratio of 1.65:1 over a 21-year mine life including pre-production and stockpile reclaim plus 2 years of leaching operation production.

Given the concern about the geotechnical stability of the ultimate pit slopes, several consultants reviewed the data, and E-Mining Technology ultimately provided the analysis that was used to design the pit. The significant amount of drilling, review of core, and analysis resulted in a delay in the delivery of the feasibility study but has improved the confidence in the design basis for the open pit. The ultimate slopes will not be mined for several years into the mine life, which allows time for additional geotechnical work to be done to improve the understanding of the rock qualities that can support those design parameters for interim and ultimate pit phases.

The Los Azules pit will be mined in 12 phases. Eighteen geotechnical sectors were defined with overall slope angles ranging from 32 to 37 degrees, according to E-Mining Technology’s geotechnical study. The shallowest overall slope angles are in the north and south of the pit, as well as in the bottom portion of the eastern side, due to a fault‑weakened zone.

Large electrically powered hydraulic shovels will be used in combination with ultra-class 360-tonne haul trucks. These are sized to mine 15-meter-high benches. To maximize productivity, efficiency and safety in a high altitude environment, the drills and haul trucks will be autonomously operated.

The Mineral Reserves for Los Azules are updated and stated in Table 1. Measured mineral resources and Indicated mineral resources were converted to Proven and Probable mineral reserves, respectively. Ore reserves were estimated using long-term metal price estimates of $4.25/ lb Cu.

| Table 1: Mineral Reserve Statement, Effective Date September 3, 2025 | ||||

| Grade | Contained Metal | |||

| Reserve Class | Tonnage (Kt) | Total Cu % | Soluble Cu % | Cu M lb |

| Proven | 229,879 | 0.683 | 0.495 | 3,463 |

| Probable | 793,173 | 0.386 | 0.259 | 6,754 |

| Total | 1,023,052 | 0.453 | 0.312 | 10,217 |

Table 1 Notes:

- The Qualified Person for the Mineral Reserve estimates is Gordon Zurowski P.Eng., an AGP employee. Mineral Reserves have an effective date of 03 September 2025. Mineral Reserves are reported on a 100% basis.

-

Mineral Reserves are estimated assuming open pit mining methods and include dilution. Recoveries were based on the extractions shown in Figure 2. Pit slopes vary by sector and range from 32° to 37°. The cut-off is variable and ranges from $4.79/t NSR to $7.23/t NSR. The copper price used was $4.25/lb Cu. Cu recovery varies by lithology. Mining costs vary by bench with a minimum of $2.14/t and a maximum of $4.11/t. Processing costs are variable and range from $3.18/t to $5.62/t leached. The processing costs include: $1.61/t G&A, $0.43/t leached for sustaining capital, and $0.15/t leached to account for closure cost. Copper cathode sales cost is $0.02/lb Cu. Copper cathode was assumed to be sold FOB the mine site.

Updated Mineral Resource Estimate

The database for resource estimation has a cutoff date of March 27, 2025. An additional 1,075 meters of drilling from four geotechnical holes, completed from early 2025 to date, were not included in the resource estimate.

The mineral resources have been classified according to guidelines and logic set out in the Canadian Institute of Mining, Metallurgy and Petroleum (CIM 2019) Definitions referred to in NI 43-101. Resources were classified as Measured, Indicated or Inferred by considering the geology, sampling, and grade estimation aspects of the model. For geology, consideration was given to the confidence in the interpretation of the lithologic domain boundaries and geometry. For sampling, consideration was given to the number and spacing of composites, the orientation of drilling and the reliability of sampling. For the estimation results, consideration was given to the confidence with which grades were estimated, as measured by the quality of the match between the grades of the data and the model.

Mineral resources are determined using an NSR cut-off value to cover the processing cost for each recovery methodology. For supergene and primary material using sulfuric acid leaching and SX/EW recovery, a marginal cut-off was used that was variable ranging from $4.79/t NSR to $7.23/t NSR. The supergene and primary material can be treated in a float mill with NSR cutoffs of $5.13/t and $5.11/t, respectively. NSR values are based on a copper price of $4.80/lb, gold at $2,500/oz and silver at $32/oz where applicable. Variable pit slopes between 32° and 37° were applied depending on sector.

The current database is sufficient for preparing a long-range model that will serve as a basis for modeling associated with completing the FS. The extent of mineralization along strike exceeds three kilometers, and the distance across strike is approximately one kilometer. The deposit is open at depth. Over the approximately 2.5 km strike length where mineralization is strongest, the average drill spacing ranges from approximately 50 meters to more than 120 meters. The central core of the enriched zone is drilled at an approximate 50 m spacing. The assay database considers 627 drillholes with 132,255 meters of assayed intervals. Resource estimation work was performed using Datamine Studio software.

Resources disclosed in Table 2 are reported in two categories related to processing amenability:

1) materials that are suited for processing in a commercially proven conventional, ambient conditions, copper bio-leaching scheme (Leach); and

2) materials that are better suited to processing either in a more advanced bio-leaching scheme such as Nuton® Technology or traditional milling/concentrator approach (Mill or Leach+).

| Table 2: Mineral Resources (Exclusive of Mineral Reserves), Effective Date September 3, 2025 | |||||||||

|

Million tonnes (MT) |

Average Grade | Contained Metal | |||||||

|

CuT % |

CuSol % |

Au (g/t) |

Ag (g/t) |

Cu (Blbs) |

Au (Moz) |

Ag (Moz) |

|||

| Measured & Indicated | Supergene Leach | 251.9 | 0.303 | 0.167 | - | - | 1.7 | - |

- |

| Supergene Mill or Leach+ | 77.6 | 0.108 | 0.042 | 0.04 | 1.11 | 0.2 | 0.1 | 2.8 | |

| Primary Mill or Leach+ | 635.9 | 0.255 | 0.046 | 0.05 | 1.17 | 3.6 | 0.9 | 23.8 | |

|

Total Measured & Indicated |

Leach & Mill or Leach+ | 965.5 | 0.255 | 0.077 | 5.4 | 1.0 | 26.6 | ||

| Inferred | Supergene Mill or Leach+ | 601.1 | 0.292 | 0.131 | 0.04 | 1.32 | 3.9 | 0.9 | 25.5 |

| Primary Mill or Leach+ | 3,638.2 | 0.201 | 0.027 | 0.04 | 1.06 | 16.1 | 4.9 | 124.5 | |

|

Total Inferred |

Leach & Mill or Leach+ | 4,239.3 | 0.214 | 0.042 | 20.0 | 5.7 | 149.9 | ||

Notes to Table 2:

- The Qualified Person for the Mineral Resource estimate is Jeff Sullivan – CRM-SA, LLC. Mineral Resources have an effective date of September 3, 2025.

- Mineral resources, which are not mineral reserves, do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, socio-political, marketing, or other relevant factors.

- The quantity and grade of reported inferred mineral resources in this estimation are uncertain in nature and there is insufficient exploration to define these inferred mineral resources as an indicated or measured mineral resource; it is expected that further infill drilling will result in upgrading the majority of this material to an indicated or measured classification.

- Reasonable prospects of eventual economic extraction are demonstrated by using a calculated NSR value in each block to evaluate an open pit shell using Measured, Indicated and Inferred blocks in Geovia Whittle™ pit optimization software. Mining costs vary by bench with a minimum of $2.14/t and a maximum of $6.38/t.

- NSR was calculated using the following: metal prices of $4.80/lb for copper, $2,500/oz for gold and $32/oz for silver, Processing costs are variable and range from $3.18/t to $5.62/t leached. Milling process cost are $5.13/t for supergene and $5.11/t for primary ores. Total freight costs of $150/t for concentrate, selling costs of $0.02/lb for copper.

- A marginal cut-off was used that was variable ranging from $4.79/t NSR to $7.23/t NSR based on extraction of the resource from the enriched zone using sulfuric acid leaching and SX/EW recovery; the recovery was calculated using the extractions shown in Figure 2 and applying a 95% operational efficiency.

- The supergene and primary material can potentially be treated in a mill/concentrator with NSR cut-offs of $5.13/t for supergene and $5.11/t for primary respectively. The mill has the added benefit of also recovering the gold and silver present in the resource. Additional parameters are used for the NSR calculation for this scenario. Mill recoveries for the secondary copper resources were 89.3% and for the primary resources were 93.2%.

- Depending on the potential depth of the pit, total pit slope angles ranged from 32° to 37° depending on the sector. Overburden slopes were set at 32°.

- Composites of 2 m length were capped where needed; the capping strategy is based on the distribution of grade which varies by location (i.e. domain or proximity to controlling structures) and the associated potential metal removal. The resource estimate is based on uncapped copper grades; local capped grades are used for gold and silver.

- Block grades were estimated using a combination of ordinary Kriging and inverse distance squared weighting depending on domain size.

- Model blocks are 20 m x 20 m x 15 m in size.

4. Metallurgy & Recovery

The metallurgical development for the Los Azules feasibility was completed in three phases:

Phase 1: Baseline testing from the test work program outlined in the 2023 PEA.

Phase 2: Testing using samples from the 2021–2022 drilling campaigns, to expand the variability database from Phase 1 and to extend the geometallurgical data set to include lithologic domains.

Phase 3: Scale-up validation using samples from the 2022-2023 exploration campaigns, to validate scale-up from the baseline 3-meter columns to the planned 9-meter bench height of the heap leach pad and to confirm extraction within the test programs. The Phase 3 master composites were built by lithologic domain and were pulled from within the pit shell for the initial five years of operation. Additional samples were collected from the 2023-2024 exploration campaign from holes drilled vertically.

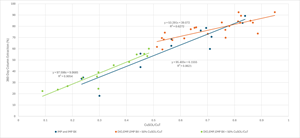

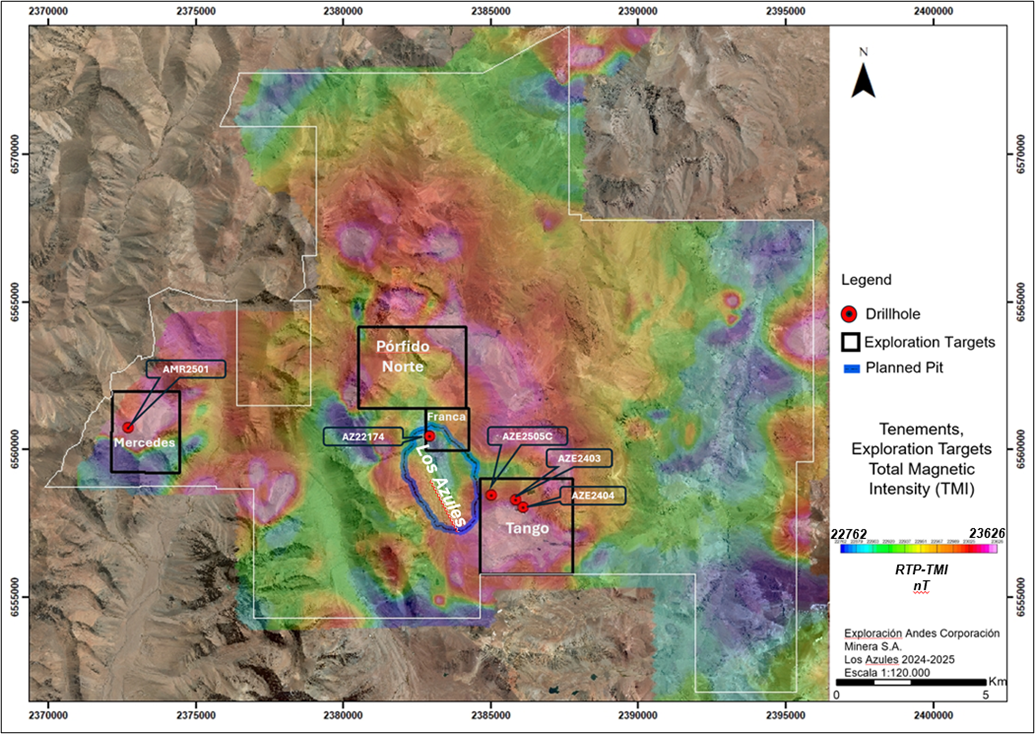

The metallurgical work completed to date provides comprehensive understanding of the expected performance characteristics of the Los Azules deposit. The anticipated copper extractions shown in Figure 2 are utilized in the block model to calculate NSR value for each block in conjunction. Copper recovered to cathodes will consider a heap efficiency and inventory factor of 95% of the extractable copper, based on general experience and industry practice.

Figure 2: All 360-day column extraction data plotted as soluble copper (CuSOL) to total copper (CuT) ratio of the head grade broken out by lithology and ratios.

Notes: IMP = Intermineral Porphyry, IMP BX = IMP Breccia, DIO = Diorite, EMP = Early Mineral Porphyry, and EMP BX = EMP Breccia

The expected overall total copper recovery is approximately 70.8% and is distributed over a three-year timeframe from placement on the leach pad to account for the timing of active leaching cycles as the pad is constructed. The copper extraction methodology best reflects the potential variability related to host rock materials and the expected variability related to copper grades, mineralogy and recovery that can be practically applied in the mining modeling. In the opinion of the QP, the metallurgical test work and analysis support the metallurgical assumptions provided and used in the mineral reserve statement, the feasibility mine plans, and the economic analysis presented in this report.

Processing of the primary ores can be achieved by using both the Nuton process, alternative leaching processes such as chloride leaching or by using a conventional milling operation to produce concentrates. The advantage of conventional milling is the additional revenue from the recovered gold and silver from the deposit. The next stage of metallurgical test work will include sufficient work to evaluate the processing method to be used for the primary ores during the detailed engineering and initial operations phase.

5. Economic Analysis

Economic Metrics

All currency shown in the FS is expressed in constant Q2 2025 United States Dollars unless otherwise noted.

The Business Case for the leach project uses a copper price assumption of $4.35/lb. Summary results are provided below in Table 3.

| Table 3: Project Metrics – Business Case | ||

| Project Metric | Unit | Number |

| Mine Life | Years | 21 |

| Tonnes Processed | Billion tonnes | 1.023 |

| Tonnes Waste Mined | Billion tonnes | 1.684 |

| Strip Ratio | 1.65 | |

| Total Copper Grade (CuT) | % CuT | 0.453% |

| Soluble Copper Grade (CuSOL) | % CuSOL | 0.312% |

| Total Copper Recovery | % | 70.8% |

| Copper Production (LOM avg.) | tonnes/yr | 148,200 |

| Copper Production (Yrs 1-5) | tonnes/yr | 204,800 |

| Copper Production – cathode Cu | ktonnes | 3,279 |

| Initial Capital Cost | USD Millions | $3,168 |

| Sustaining Capital Cost | USD Millions | $2,131 |

| Closure Costs | USD Millions | $386 |

| C1 Cost (Life of Mine) | USD/lb Cu | $1.71 |

| All-in Sustaining Costs (AISC) | USD/lb Cu | $2.11 |

| Before Taxes | ||

| Net Cumulative Cashflow | USD Millions | $12,721 |

| Internal Rate of Return (IRR) | % | 24.3% |

| Net Present Value (NPV) @ 8% | USD Millions | $4,280 |

| After Taxes | ||

| Net Cumulative Cashflow | USD Millions | $9,647 |

| Internal Rate of Return (IRR) | % | 19.8% |

| Net Present Value (NPV) @ 8% | USD Millions | $2,940 |

| Pay Back Period | Years | 3.87 |

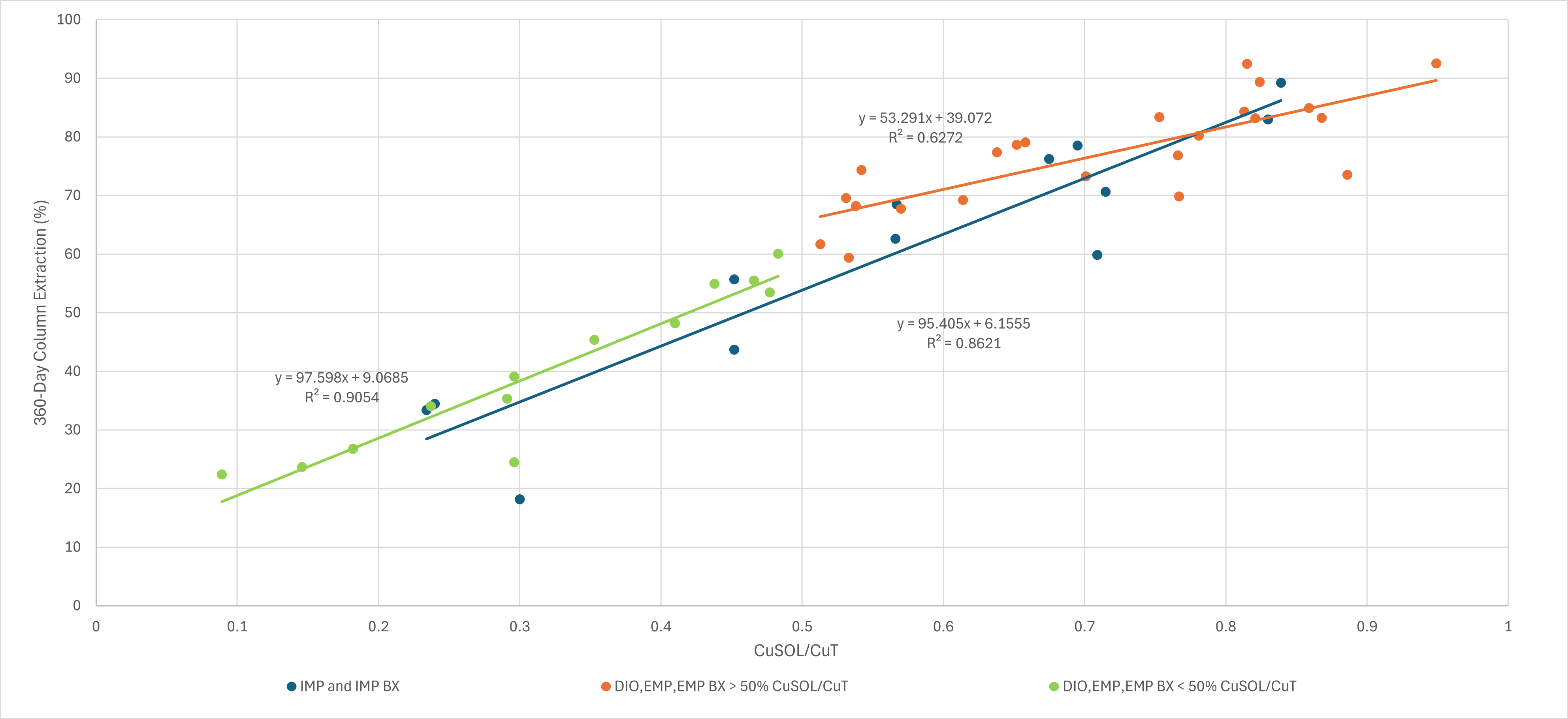

The FS for Los Azules envisions an average annual copper cathode production of 451 million lbs per year (204,800 tonnes) during the first five years of operation, representing an increase of 50 million lbs per year compared to the initial five years of the 2023 PEA production schedule. Over the 21-year life of mine, the average annual copper cathode production is projected at 327 million lbs per year (148,200 tonnes).

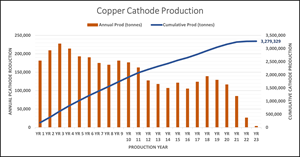

Based on the LOM extraction of mineralized material containing approximately 10.2 billion lbs (4.63 million tonnes) of total copper, and an average copper recovery of 70.8%, total copper recoverable to cathode is 7.23 billion lbs (3.28 million tonnes). The copper production by year is shown in Figure 3:

Figure 3: Copper Cathode Production by Year

Other economic metrics:

- Initial capital expenditure $3.17 billion

- Project capital intensity $9.18/ lb Cu per year (or $20,200/ t Cu per year) based on Initial capital / average annual production, or $0.73/ lb Cu (or $1,600/ t Cu) based on LOM Capex / LOM production(8).

- Average EBITDA(9) per year $1.31 billion for Years 1-5 and $696 million for Years 6-21.

A Nuton® Technology Case is considered in the opportunity section of the FS as a separate project at a PEA-level of study. That case would process primary material stockpiled during the mining of the leach project and mineral resources outside of the Mineral Reserve pit with low soluble copper content. The Nuton case would use the existing processing facilities to support the operation, with a new leach pad and Pregnant Leach Solution pumped back to the original solvent exchange & electrowinning facility. The use of Nuton® Technology has the potential to extend the life of the project and will continue to be evaluated after the conclusion of the FS.

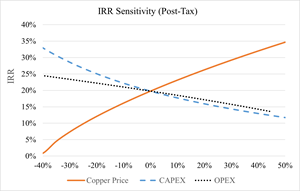

Sensitivity Analysis

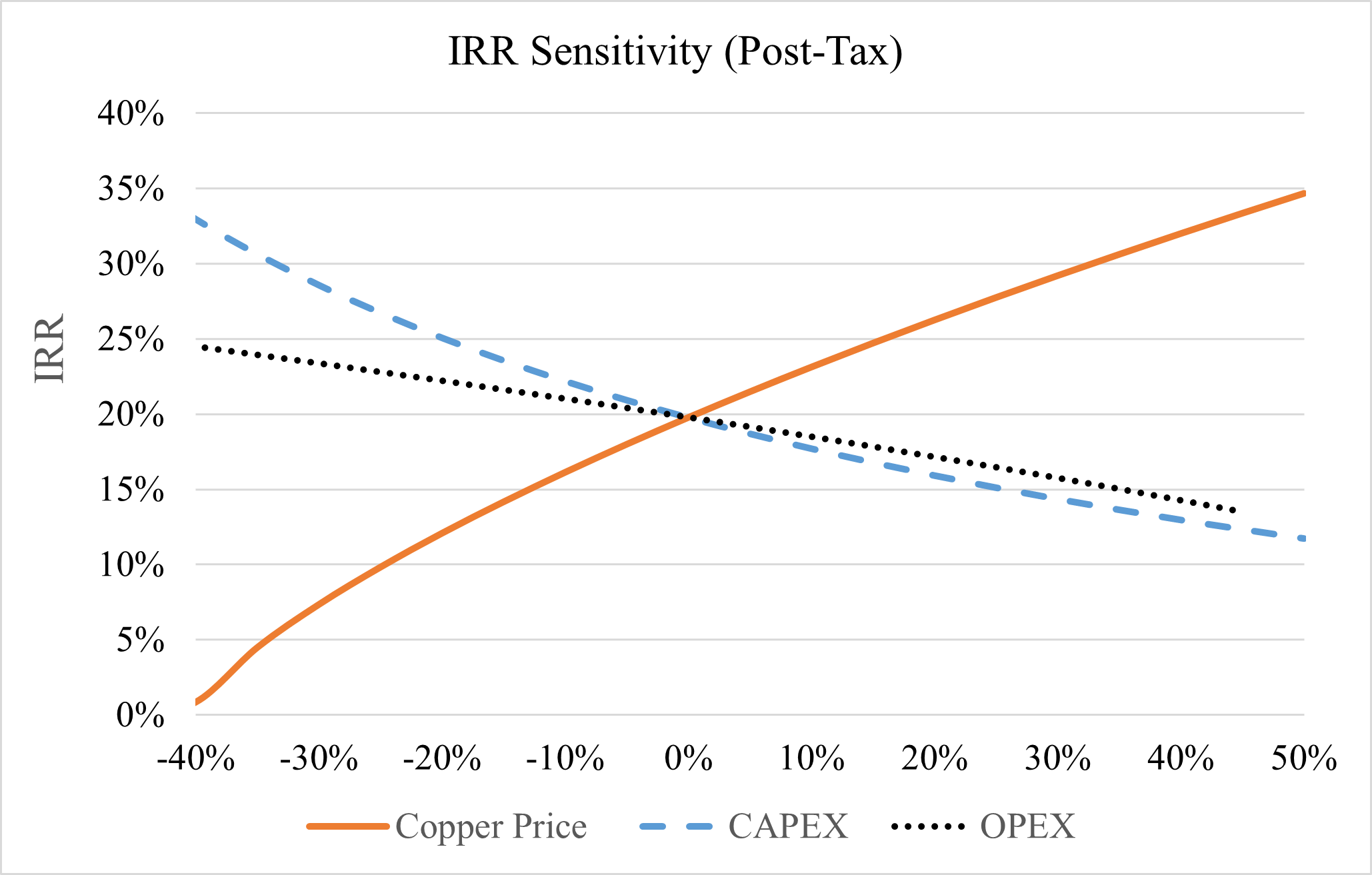

The leach project economics remain attractive (i.e. with an after-tax IRR of 15% or above) at a copper price above $3.74 per pound and are similarly resistant to an increase in LOM capital expenditure of up to 25% and an increase in operating expenses of up to 37% (see Figure 4 below).

Table 4 below shows the sensitivity of the leach project’s after-tax economics to copper price fluctuations (+/- 20%). The project after-tax NPV8% is breakeven at a copper price of $3.10 per pound.

| Table 4: Project Copper Price Sensitivity | ||||

| Sensitivity to Change in |

Metal Pricing | After-Tax | ||

| Cu Price |

Copper Price | NPV | IRR | Payback |

| (%) |

$ Cu/lb | $M | % | Years |

| -20% | $3.48 | $902 | 12% | 5.78 |

| -15% | $3.70 | $1,411 | 14% | 5.15 |

| -10% | $3.92 | $1,921 | 16% | 4.68 |

| -5% | $4.13 | $2,430 | 18% | 4.33 |

| 0% | $4.35 | $2,940 | 19.8% | 3.87 |

| 5% | $4.57 | $3,449 | 21% | 3.59 |

| 10% | $4.79 | $3,956 | 23% | 3.39 |

| 15% | $5.00 | $4,461 | 25% | 3.23 |

| 20% | $5.22 | $4,966 | 26% | 3.06 |

Table 5 below shows the sensitivity of the project economics to initial and sustaining capital expenditure escalation on an after-tax basis.

| Table 5: Project Initial & Sustaining CAPEX Sensitivity | |||

| Sensitivity to Increased CAPEX (%) | After-Tax | ||

| NPV | IRR | Payback | |

| $M | % | Years | |

| 0% | $2,940 | 19.8% | 3.87 |

| 5% | $2,773 | 19% | 4.18 |

| 10% | $2,606 | 18% | 4.41 |

| 15% | $2,440 | 17% | 4.60 |

| 20% | $2,273 | 16% | 4.78 |

| 25% | $2,107 | 15% | 4.99 |

Table 6 below shows the sensitivity of the project economics to operating expenditure escalation on a after-tax basis.

| Table 6: Project OPEX Sensitivity | |||

| Sensitivity to Increased OPEX (%) | After-Tax | ||

| NPV | IRR | Payback | |

| $M | % | Years | |

| 0 | $2,940 | 19.8% | 3.87 |

| 5% | $2,746 | 19% | 4.00 |

| 10% | $2,553 | 18% | 4.18 |

| 15% | $2,359 | 18% | 4.32 |

| 20% | $2,166 | 17% | 4.43 |

| 25% | $1,973 | 16% | 4.54 |

Figure 4: Chart of IRR Sensitivity (After-Tax) Relative to Copper Price, CAPEX and OPEX

6. Capital & Operating Costs

Capital Costs Estimates

The project includes the development of an open pit mine with multi-stage crushing and screening, a heap leach pad, and a copper solvent extraction-electrowinning (SX/EW) facility with a nominal production capacity of 215 ktpa copper cathodes (design maximum 240 ktpa). Initial capital infrastructure for the Base Case includes the following facilities:

- Mine development and associated infrastructure

- Coarse rock storage and ore handling (crushing, conveying, agglomeration)

- Heap leach pads and conveyor stacking systems

- SX/EW facility

- Sulfuric acid plant

- On-site utilities and ancillary facilities including a construction camp

- Off-site infrastructure: power transmission line (outsourced), access roads, and permanent camp

The Project’s initial capital costs are based on budgetary quotes for major equipment, recent in-house cost information and installation factors, and regional contractor inputs and facilities obtained between Q2 and Q3 2025. The capital costs for the project are summarized in Table 5 and should be viewed with the level of accuracy expected for a Feasibility Study.

Design allowances for materials quantities and labor and contingencies were included in the project estimate.

| Table 7: Project Initial Capital Cost | |

| Description | Cost ($M) |

| Direct On-Site Facilities | |

| Mine Facilities, Equipment, Pre-Production | $805.9 |

| Ore Storage & Handling | $283.3 |

| Heap Leach | $331.6 |

| SX-EW | $188.5 |

| Sulfuric Acid Plant | $114.3 |

| Ancillary Facilities | $123.4 |

| Site Development & Yard Utilities | $101.6 |

| Water Supply | $29.6 |

| Direct Off-Site Facilities | |

| Power Supply (see below) | -0- |

| Local Support Facilities | $16.4 |

| Access Roads | $93.6 |

| Logistics Activities Zone (LAZ) | $45.6 |

| Total Direct Cost | $2,133.7 |

| Project Indirects & Construction Services | |

| Contractor Indirect Cost | $41.7 |

| Catering, Camp Operations & Maintenance | $94.6 |

| Contracted Services | $89.6 |

| Construction Equipment, Tools & Supplies | $14.6 |

| Freight & Duties | $59.3 |

| Field Startup & Vendor Services | $15.1 |

| Spares, Initial Fills (incl. Mining) | $65.5 |

| Project Indirect/ Project Management Labor | |

| EPCM Services | $139.2 |

| Owner's Cost | |

| Owner Project Team | $7.6 |

| Office Costs & Assets incl. vehicles | $0.6 |

| Owner Services Cost | $28.8 |

| Owner Preproduction G&A Costs | $104.7 |

| Opex During Ramp-up | $34.8 |

| Total Indirect Cost | $691.0 |

| Design Growth Allowances | $44.3 |

| Contingency | $293.9 |

| Total Capital Cost | $3,167.9 |

YPF Funding Power Supply

The construction cost of the Power Supply line to site and the electrical system upgrades total approximately $440 million which has not been included in the capital estimate as YPF Luz, a large Argentinean power utility company, will be constructing the line at their expense pursuant to a long-term, renewable power purchase agreement and connection repayment that will follow the terms agreed to in a Memorandum of Understanding.

To date, the company received preliminary finance proposals from Tier-1 OEMs and European export credit agencies for opportunities exceeding $1.1 billion for infrastructure and technology, covering 85 to 100% of major mechanical equipment and local installation costs – see the Strategic Partnerships section.

Operating Costs Estimates

Table 8 summarizes the LOM project operating costs per tonne of material processed and per pound of copper produced.

| Table 8: LOM Project Cash Costs | ||

| Description |

LOM Cost/tonne ($) |

LOM Cost/lb ($) |

| Mining | 6.22 | 0.87 |

| Processing | 3.83 | 0.54 |

| General & Administrative | 1.86 | 0.26 |

| Selling Expenses | 0.28 | 0.04 |

| LOM C1 Costs | 12.05 | 1.71 |

7. ESG & Sustainability

Environmental Highlights:

- Process water use: 159 L/s LOM average, 74% lower than a conventional mill producing copper concentrate with approx. 600 L/s(10).

- Peak Site Water use: 244.2 L/s, with 227 L/s allocated for mining activities and 17.2 L/s for human use.

- Electricity demand: 119 MW (48% lower than a concentrator)

-

GHG emissions: For the current project basis, the estimated annual average Green House Gas (GHG) emissions for the Los Azules project is 1,082 kg CO2-e/t Cu from Scope 1 and 2 sources. This places the project on the lowest decile of the copper industry carbon curve, well below the estimated industry average of 4,026 kg CO2-e/t Cu(5) using Skarn Associates mine-to-metal “E1” metric(13). At the start of operations, Los Azules will already be one of the lowest carbon copper cathodes produced in the world.

The project continues to develop electrification strategies for the mine and overall project including application of trolley assist for mine haulage, in-pit crushing and conveying and waste conveyance. The timing for these applications and others is under final analysis. Los Azules is also well positioned to take advantage of emerging opportunities (e.g. battery electric mine and services vehicles) and longer-term developing technologies. - Goal: McEwen Copper is committed to becoming carbon neutral by 2038 at Los Azules, a target achievable using emerging technologies and offsets.

The project will source 100% renewable energy (wind, hydro, solar) and aims for net positive impacts on local ecosystems and communities.

8. Permitting & Regulatory Status

The Environmental Impact Assessment (EIA) for Los Azules was granted on December 3, 2024.

On September 26, 2025, Los Azules was accepted into the Large Investment Incentive Regime RIGI. The investment regime provides the project with legal, fiscal, and customs stability for 30 years, including:

- Legal certainty, including tax, customs and foreign exchange stability for 30 years, with improved mechanisms in comparison with a prior regime applicable to mining activities, and access to international arbitration should a dispute arise.

- Tax incentives in the investment phase -such as release from VAT payments which significantly reduces the financial burden during construction- and in the operation phase, such as the reduction of the corporate income tax rate to 25% from the general 35%, a 50% reduction in the dividend withholding tax, no export tax, an accelerated depreciation for new capital investments, and exemption from export duties.

- Streamlined customs procedures, including duty and tax exemptions to import of capital goods and the ability to leave export proceeds in foreign bank accounts, available to be applied to debt repayment or any other goal.

The Water Concession permit applications are currently under review with the provincial government. The use of heap leach technology, which is well accepted in San Juan Province, reduces permitting complexity by eliminating tailings and conserving water.

9. Nuton® Opportunity

Nuton is a technology venture of Rio Tinto that became a strategic partner of McEwen Copper in 2022. The Nuton® Technology is a suite of proprietary technologies that provide opportunities to leach both primary and secondary copper sulfides, providing a significant opportunity to optimize mine plans and overall mining and processing operations. In addition, Nuton® Technology provides significant other benefits, such as lower overall energy consumption, lower CO2 emissions, smaller land footprint, and lower water consumption per unit of copper produced than conventional sulfide mineralization recovery processes.

Based on strategic planning work by Whittle Consulting and considering the inferred resources, the use of Nuton offers the opportunity to extend the mine life beyond conventional leaching by 30 years or more.

Based on preliminary scoping testing, the Nuton® Technology offers the potential for copper recoveries of up to 85% on primary copper sulfide ore bodies, depending on the specific mineralogy make-up of the mineral resource. At Los Azules, the Nuton® Technology has the potential to economically process the large primary sulfide copper resource as an alternative to a concentrator, with low incremental capital following the oxide and supergene leach, no tailings requirement, and a smaller environmental footprint. Producing copper cathode with Nuton® on-site also has the advantage of simplifying outbound logistics in comparison to copper concentrates and offers a finished product to the domestic and international market.

The outcomes modelled using Nuton’s proprietary computational fluid dynamics model are very encouraging and indicate that unoptimized copper recovery to cathode from primary material using Nuton® Technology should range from 73% to 79%. Furthermore, recovery from secondary material using Nuton® Technology is high, ranging from 80% to 86%. This could provide a significant opportunity to optimize the mine plan and reduce the need for selective mining, as simultaneous stacking of both secondary and primary mineralization will not impact the copper recovery of either material type. Based on the current resource estimate, using Nuton® Technology in the project could have a significant positive impact on the expected life of the mine and the projected cashflow, without significantly increasing the initial capital investment required.

Column leaching of Los Azules composite samples at Nuton® facilities was completed in Q1 2024 and used to support modelled metallurgical recoveries. Testing has been completed at Nuton facilities with a Phase 2a program, developing process design criteria and evaluating performance tested at a 10 m tall, large column scale. Fully mass balanced results are expected to be completed in Q4 2025. Preliminary assessment of the assay data suggests similar results to those provided in the PEA document. Besides refining and validating modelled data through additional column testing for Los Azules, Nuton is progressing an industrial-scale deployment at the Johnson Camp Mine (JCM) owned and operated by Gunnison Copper Corporation Inc. in Arizona, USA. This deployment’s aim is to validate the Nuton® Technology package, from design and engineering to commissioning and operation, and to de-risk future Nuton deployments like the potential one at Los Azules.

McEwen Copper and Nuton are actively collaborating to deploy the Nuton® Technology at Los Azules. While a formal commercial agreement is not yet in place, both parties are committed to working in good faith toward establishing such an arrangement.

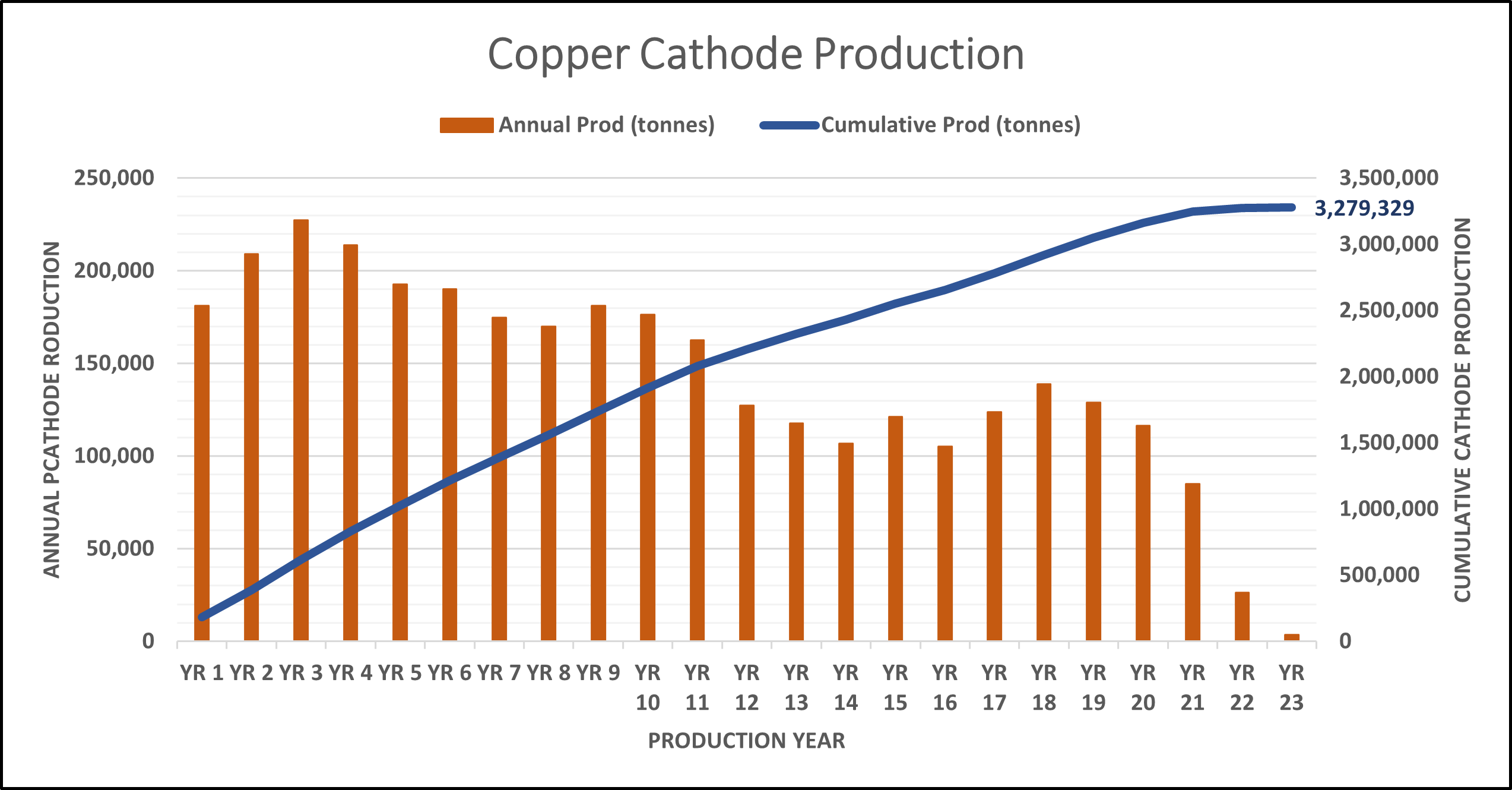

10. Development Timeline

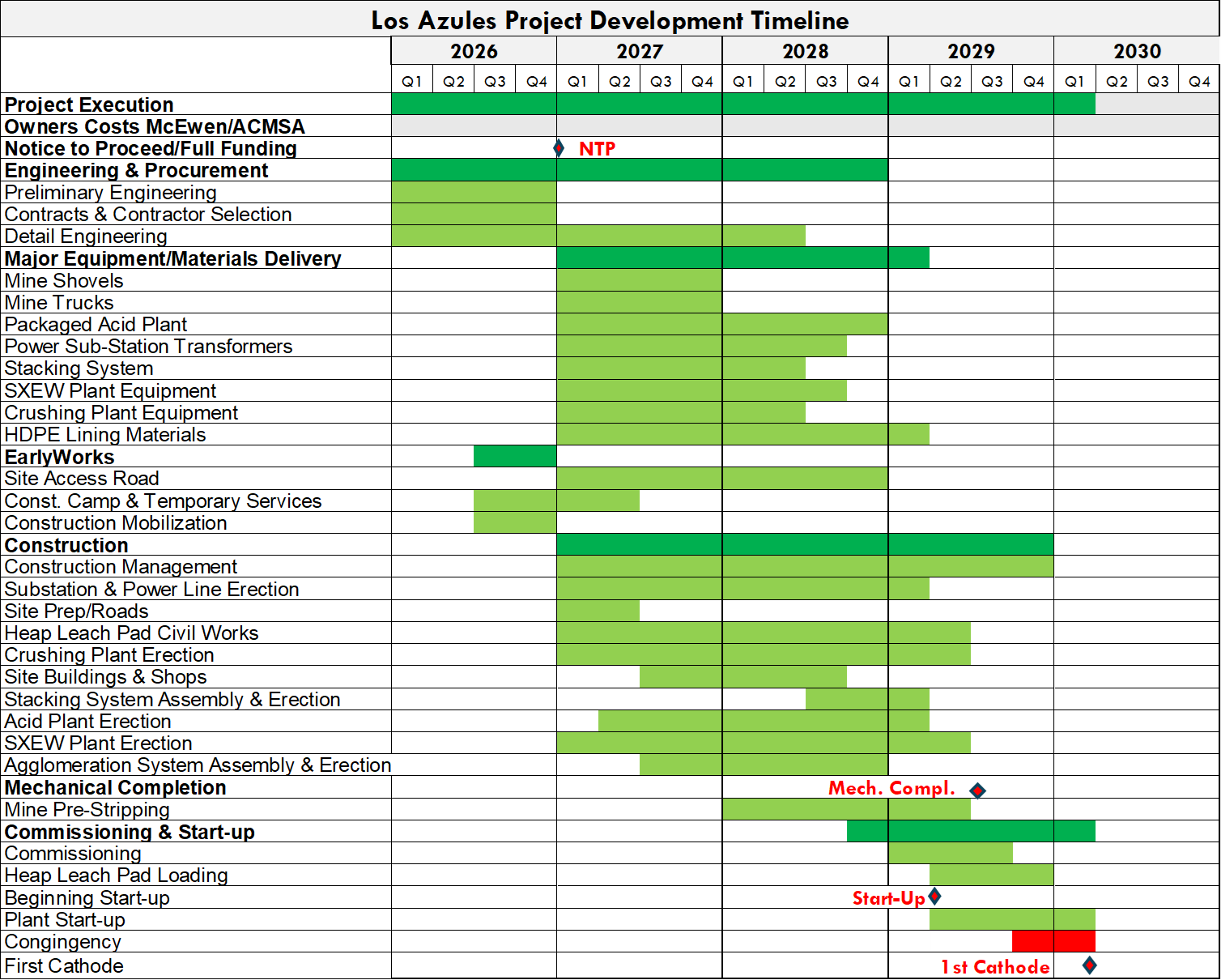

The Gantt chart below presents a simplified project development timeline based on regional contractor inputs and long-lead equipment and materials delivery assumptions provided by vendors.

The schedule assumes that the feasibility study work is completed in October 2025, necessary permits to begin work are completed, and initial financing is in place to achieve the scheduled milestones.

Following this Level 3 schedule, the SX/EW plant could start in 2029, and the first cathode would be produced in 2030.

Figure 5: - Gantt Chart for Los Azules Project Development Timeline

11. Strategic Partnerships

McEwen Copper partnered with Nuton to evaluate the application of Nuton® Technology for the treatment of primary mineralization at the Los Azules project. Nuton also holds a 17.2% equity stake in McEwen Copper.

Stellantis, the world's fifth largest automaker, is also a strategic shareholder with an 18.3% interest. The partnership includes a copper cathode and concentrates purchase rights agreement and a joint commitment to achieving carbon neutrality by 2038.

As of the date of this release, McEwen Copper has received preliminary finance proposals with referential conditions from Tier 1 OEMs including, Komatsu, and Sandvik, as well as from European export credit agencies, covering 85 to 100% of the major mechanical equipment and 50% of the local construction cost for the project. The Argentine power company YPF Luz has signed an agreement with Los Azules to provide financing for the upgrades to the power grid and the power supply to the mine site and has agreed to provide 100% renewable power to the project. These proposals open the opportunity to finance more than $1.1 billion in investments for the crushing and handling system, SX/EW plant, acid plant, drilling fleet, and hauling and loading mining fleet, incorporating state-of-the-art technologies that support our regenerative guiding principles and commitment to sustainable innovation.

In September 2025, McEwen Copper announced that it had signed a collaboration agreement with the International Finance Corporation (IFC), a member of the World Bank Group, to support the alignment of the Los Azules copper project with IFC’s ESG standards for potential future financing. This represents an important milestone in the company’s broader financing strategy, helping to align the project with top-tier sustainability standards while paving the way for IFC as a potential lead lender and equity partner.

12. Study Contributors and Qualified Persons

The FS Technical Report is prepared in accordance with the requirements set forth by Canadian National Instrument 43-101 (“NI 43-101”) for the disclosure of material information and is intended to meet the requirements of a Feasibility Study (FS) level of study and disclosure as defined in the regulations and supporting reference documents. The effective date of the report is September 3, 2025.

The report was prepared by Samuel Engineering Inc., with contributions from Knight Piésold Consulting, AGP Mining Consultants Inc, Nuton, a Rio Tinto Venture, E-Mining Technology S.A., Call & Nicholas, Inc., Itasca Consulting Group, Inc., CRM-SA, LLC, McLennan Design/Perkins&Will, Whittle Consulting Pty Ltd, Techint S.A.C.I., BW Hidrogeología y Medioambiente, and SRK Consulting UK Limited, under the supervision of David Tyler, McEwen Copper Project Director.

The feasibility study and associated disclosures have been reviewed and verified by the following qualified persons under NI 43-101 – Standards of Disclosure for Mineral Projects:

- Technical aspects of this news release related to Project Execution, Development information, and other information excluding mineral resource disclosure, have been reviewed and verified by James L. Sorensen – FAusIMM Reg. No. 221286 with Samuel Engineering.

- Technical aspects of this news release related to McEwen information, and other information excluding mineral resource disclosure, have been reviewed and verified by David Tyler – SME Registered Member. No. 3288830. He is the Project Director of the Los Azules Project and is not independent of the issuer.

- Technical aspects of this news release related to Metallurgical Summary and Process Information, have been reviewed and verified by Michael McGlynn – SME Registered Member No. 4149430 with Samuel Engineering.

- Disclosure related to the updated Los Azules mineral resource estimate has been reviewed and approved by Jeff Sullivan – FAusIMM Reg. No. 201778 with CRM-SA, LLC.

- Disclosure related to the initial Los Azules mining, and mineral reserve estimate has been reviewed and approved by Gordon Zurowski, P.Eng with AGP Mining Consultants.

- Technical aspects of this news release related to Financial Modeling, have been reviewed and verified by Steve Pozder – P.E. with Samuel Engineering.

13. End Notes

(8) Project capital intensity is defined as Initial Capex ($) / LOM Avg. Annual Copper Production (lbs or tonnes per year) or as LOM Capex ($) / LOM Copper Production (lbs or tonnes). C1 cash costs per pound produced is defined as the cash cost incurred at each processing stage, from mining through to recoverable copper delivered to the market, net of any by-product credits. All-in sustaining costs (AISC) per pound of copper produced adds production royalties, non-recoverable VAT and sustaining capital costs to C1. AISC margin is the ratio of AISC to gross revenue. Capital intensity, C1 cash costs per pound of copper produced, AISC per pound of copper produced, and AISC margin are all non-GAAP financial metrics. Numbers may not total due to rounding.

(9) Annual earnings before interest, taxes, depreciation, and amortization (EBITDA). EBITDA is a non-GAAP financial measure.

(10) 2017 NI 43-101 Technical Report on Los Azules Project, Hatch Engineering (Throughput of 120,000 tpd of mineralized material).

(11) 2023 NI 43-101 Technical Report on Los Azules Project, Samuel Engineering.

(12) Kilograms of Carbon Dioxide Equivalent per tonne of Copper Equivalent produced. Carbon Dioxide Equivalent means having the same global warming potential as any other greenhouse gas.

(13) Skarn Associates Copper Mine GHG and Energy Intensity Curve Generator, June 2025 dataset for the year 2030. The E1 metric includes all GHG emissions from mine to refined metal. Skarn recommends E1 intensity as the most suitable metric for comparing operations, allowing SXEW and concentrate producers to be evaluated on the same curve, at the same product boundary - refined copper cathode.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Inc.'s estimates, forecasts, projections, expectations or beliefs as to future events and results for both its consolidated operations and those of McEwen Copper Inc. (“McEwen Copper“, “the company”). Forward-looking statements and information regarding McEwen Inc. and McEwen Copper (“the companies”) are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, fluctuations in the market price of precious and base metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the companies to receive or receive in a timely manner permits or other approvals required in connection with operations, the risk that the RIGI regime may be curtailed, extinguished or amended, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, foreign exchange volatility, foreign exchange controls, foreign currency risk, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The companies undertake no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Inc.'s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding McEwen Inc. and McEwen Copper. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Inc. and McEwen Copper.

Want News Fast?

Subscribe to our email list:

https://www.mcewenmining.com/contact-us/#section=followUs

Contact Information

| WEB SITE | SOCIAL MEDIA | |||||

| www.mcewenmining.com | McEwen Inc | Facebook: | facebook.com/mceweninc | |||

| LinkedIn: | linkedin.com/company/mcewen-mining-inc- | |||||

| CONTACT INFORMATION | X: | x.com/mceweninc | ||||

| 150 King Street West | Instagram: | instagram.com/mceweninc | ||||

| Suite 2800, PO Box 24 | ||||||

| Toronto, ON, Canada | McEwen Copper | Facebook: | facebook.com/ mcewencopper | |||

| M5H 1J9 | LinkedIn: | linkedin.com/company/mcewencopper | ||||

| Twitter: | twitter.com/mcewencopper | |||||

| Investor Relations: | Instagram: | instagram.com/mcewencopper | ||||

| (866)-441-0690 - Toll free line | ||||||

| (647)-258-0395 | Rob McEwen | Facebook: | facebook.com/mcewenrob | |||

| Mihaela Iancu ext. 320 | LinkedIn: | https://www.linkedin.com/in/robert-mcewen-646ab24 | ||||

| info@mcewenmining.com | Twitter: | twitter.com/robmcewenmux | ||||

Photos accompanying this announcement are available at

Figure 1: Los Azules deposit (outlined in blue), and exploration targets Mercedes, Porfido Norte, Franca and Tango (black squares). Satellite image with Total Magnetic Intensity map.

Figure 1: Los Azules deposit (outlined in blue), and exploration targets Mercedes, Porfido Norte, Franca and Tango (black squares). Satellite image with Total Magnetic Intensity map.

Figure 2: All 360-day column extraction data plotted as soluble copper (CuSOL) to total copper (CuT) ratio of the head grade broken out by lithology and ratios.

Figure 2: All 360-day column extraction data plotted as soluble copper (CuSOL) to total copper (CuT) ratio of the head grade broken out by lithology and ratios.

Figure 3: Copper Cathode Production by Year

Figure 3: Copper Cathode Production by Year

Figure 4: Chart of IRR Sensitivity (After-Tax) Relative to Copper Price, CAPEX and OPEX

Figure 4: Chart of IRR Sensitivity (After-Tax) Relative to Copper Price, CAPEX and OPEX

Figure 5: - Gantt Chart for Los Azules Project Development Timeline

Figure 5: - Gantt Chart for Los Azules Project Development Timeline

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.